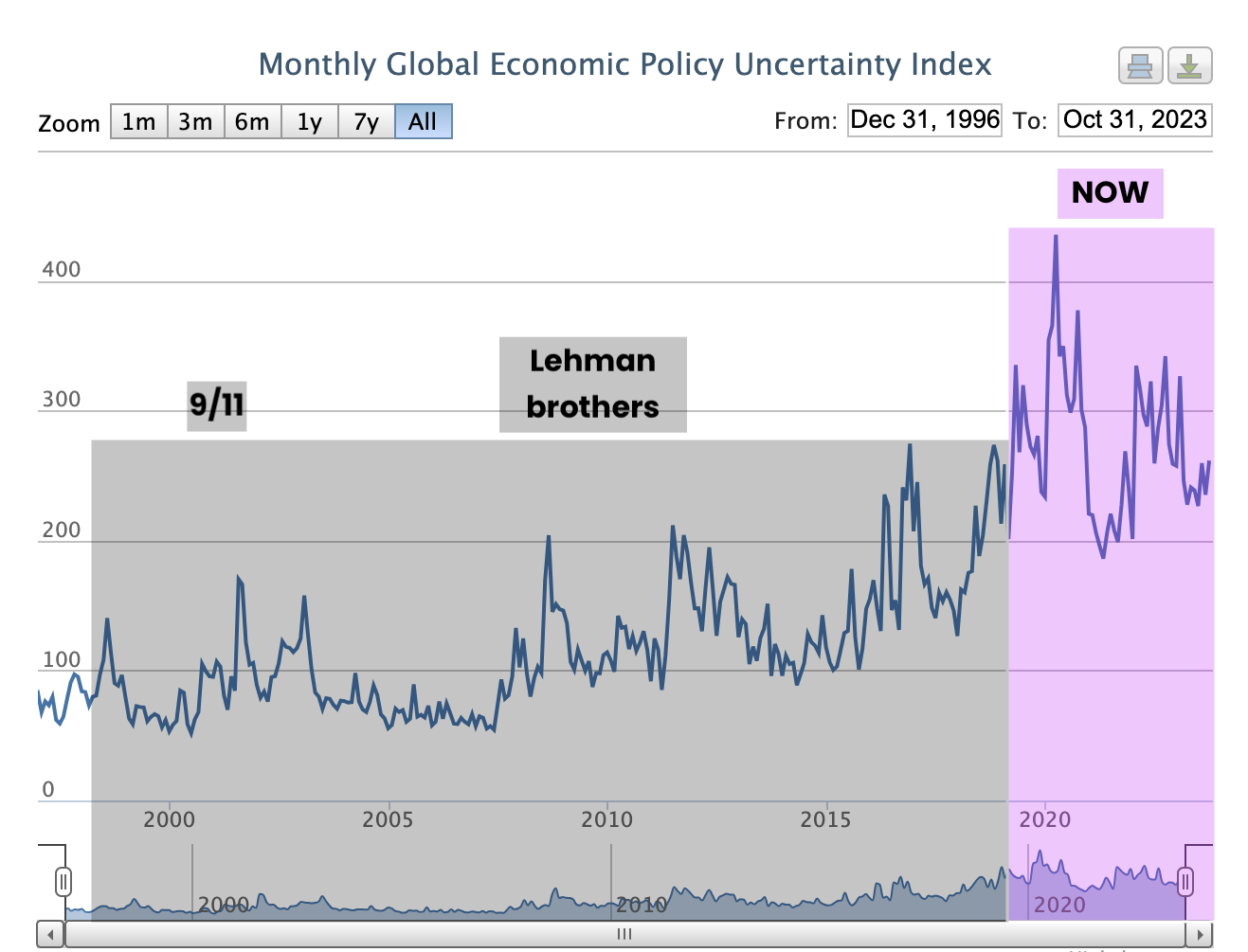

Remember how it felt like plateaus were moving when the 9/11 attack took place, or when Lehman Brothers collapsed and the financial crisis started? At that point in time, these events were like earthquakes in the economic operating environment. Well, it was only the beginning of an era of uncertainty at an unseen level.

Lets take a look at the past and current situation:

Macroeconomic uncertainty may be a growing concern, but researchers worldwide have been studying it for the last decade.

Largely out of the public eye, they have identified and measured the far-reaching effect of what is referred to as Economic Policy Uncertainty, aka EPU. It reflects how a national economy fluctuates due to unpredictable fiscal, political, regulatory or monetary policies. EPU-related research has accelerated since 2016, when a team of U.S. academics developed this index. The EPU index is constructed from newspaper coverage, provisions in federal tax codes that are set to expire, and disagreement among economic forecasters.

Economic policy uncertainty arising from recessions, pandemics, poisoned politics and confusing tax policies have real-world consequences.

If we look back at the past years of rapidly growing burnout rates, the great resignation and turmoil nationally and globally, this trend gives very good intel on the root causes of stress and burnouts. Nothing in the surrounding operating environment suggest, that this situation will get better anytime soon.

Strong volatility and uncertainty can and should be seen as both risk and opportunity. With such strong volatility in the uncertainty levels there are both winners and losers in larger scale. The risks are bigger, but so are the opportunities.

THE C-LEVEL IMPERATIVE

Nothing in the current economic environment suggest that things wILL get any easier anytime soon. Management needs tools that enable them to get on top of the turbulence and make sense from it:

- Internal data doesn’t cut it. Companies need to monitor external factors like energy prices, inflation, rising cost of funding etc. with the impacts that they have on customers and their risk and readiness.

- Making informed scenarios about shifts in the market place. History is there for us to learn from. Make certain that you can take the past, learn from it, and apply that learning to your future decisions.

- Black Swans and adaptation: By definition, Black Swans are unpredictable. However, if you have the data and monitoring in place, you will be able to make sense of the situation faster than your competitors. Getting on top of a Black Swan can be an opportunity of a lifetime. (If you’d like to read more about Black Swans, I highly recommend the book The Black Swan: The Impact of the Highly Improbable by Nassim Nicholas Taleb.)

- Priorities shift like never before. One offering rapidly declines while another one gains demand. One target group falls into risk and seize negotiations while another target group or segment wakes up and starts negotiating.

Success is now strongly dependent on your capability to get on top of changes, adapt and take advantage of emerging opportunities while managing risks. The rollercoaster economy can be a paradise for those capable of making most of it.

Sources:

https://smith.queensu.ca/insight/content/The-Cost-of-Uncertainty.php